Welcome to the TOPAZ Investors Portal!

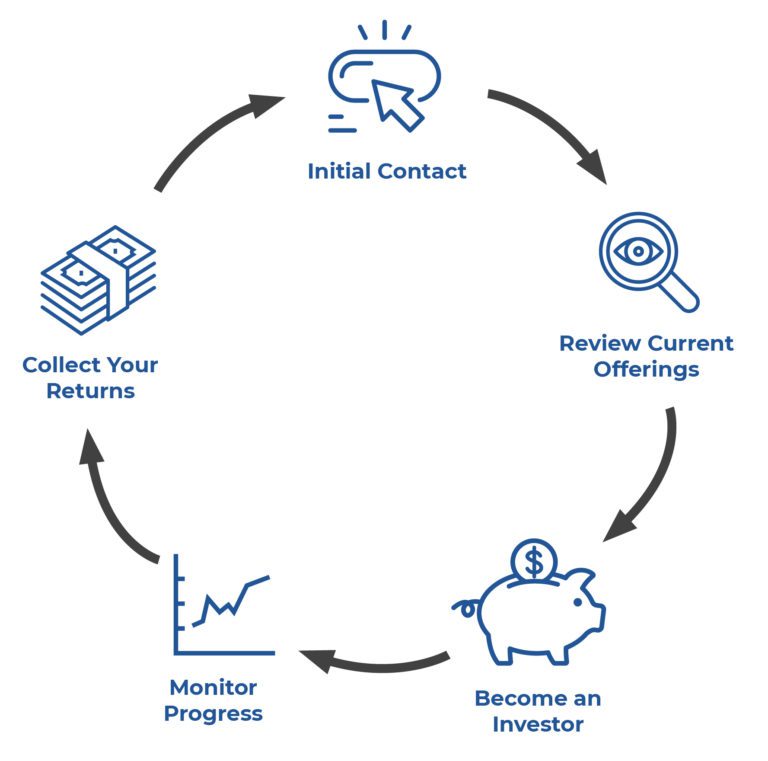

This restricted area of our website is for current and prospective investors. If you would like access, please contact us at IR@TopazCG.com or (917) 708-1965.

TOPAZ takes an entrepreneurial approach to multifamily investing. We pursue deals that are traditionally unattractive to institutional-style investors and require a hands-on asset management approach to generate attractive risk-adjusted returns.

To develop effective improvement strategies, we focus on sub-market demographics, supply and demand imbalances, positive development trends and surrounding income levels for our targeted demographic.

Our In-depth, Property-Level Micro Analyses Enable Us To:

TOPAZ manages finances diligently while carefully balancing risks and rewards. Because we discover promise where others fail to look, we always have high-potential opportunities for qualified investors. Thanks to the right strategy, timing and price, our assets generate results.

- Assess income and operations for efficiencies.

- Put in place capital structures that help increased leveraged returns and limit downside risk.

- Anticipate any property condition issues to limit any physical surprises.

- Complete strategic unit improvements and common area and exterior upgrades to improve tenant quality of life and loyalty.

Investor Inquiry

Thank you for your interest in partnering with Topaz Capital. At this time we are only accepting investments from accredited investors.

To obtain information on new offerings and begin the conversation about possibly partnering with us on a future deal, please fill out the information and we will be in touch with you.

Are You Interested in Investing with TOPAZ? Help us get to know each other by filling out this form.

Disclaimer / Disclosure / Risk Factors

- No public market currently exists, and one may never exist, for the interests of any TOPAZ-sponsored program. The purchase of interests in any TOPAZ-sponsored program is suitable only for persons who have no need for liquidity in their investment and who can afford to lose their entire investment.

- TOPAZ-sponsored programs offer and sell interests pursuant to exemptions from the registration provisions of federal and state law and, accordingly, those interests are subject to restrictions on transfer.

- There is no guarantee that the investment objectives of any particular TOPAZ-sponsored program will be achieved.

- The actual amount and timing of distributions paid by TOPAZ-sponsored programs is not guaranteed and may vary. There is no guarantee that investors will receive distributions or a return of their capital.

- Investments in real estate are subject to varying degrees of risk, including, among other things, local conditions such as an oversupply of space or reduced demand for properties, an inability to collect rent, vacancies, inflation and other increases in operating costs, adverse changes in laws and regulations applicable to owners of real estate and changing market demographics.

- TOPAZ-sponsored programs depend on tenants for their revenue, and may suffer adverse consequences as a result of any financial difficulties, bankruptcy or insolvency of their tenants.

- TOPAZ-sponsored programs may own single-tenant properties, which may be difficult to re-lease upon tenant defaults or early lease terminations.

- Continued disruptions in the financial markets and challenging economic conditions could adversely affect the ability of an TOPAZ-sponsored program to secure debt financing on attractive terms and its ability to service that indebtedness.

- The prior performance of other programs sponsored by TOPAZ should not be used to predict the results of future programs.

- The TOPAZ-sponsored programs do not have arm’s length agreements with their management entities.

- The TOPAZ-sponsored programs pay significant commissions and fees to affiliates of TOPAZ, which may affect the amount of income investors earn on their investment.

- Persons performing services for the managers of the TOPAZ-sponsored programs perform services for other TOPAZ-sponsored programs, and will face competing demands for their time and service.

- The acquisition of interests in an TOPAZ-sponsored program may not qualify under Section 1031 of the Internal Revenue Code of 1986, as amended (the “Code”) for tax-deferred exchange treatment.

- Changes in tax laws may occur, and may adversely affect an investor’s ability to defer capital gains tax and may result in immediate penalties.

- The Delaware statutory trust structure is inflexible and, in certain events, may be converted to a LLC structure, which would have a tax impact on investors.