Customized 1031 Exchanges Sponsored by TOPAZ

TOPAZ TEN31 Xchange is built for our clients as a one-stop shop offering replacement properties, capital advisory, trusted tax and legal counsel, and creative multiple-owner structures we’ve created for 1031 exchange transactions nationwide!

TOPAZ’s expertise in both debt and equity deals gives us the ability to properly identify the perfect property for your 1031 needs. Acting as the sponsor, TOPAZ will tie up the deal and work with our in-house lawyers to collect the information needed to prepare the exchange documents. Post-closing, TOPAZ will work with our regional property managers to manage the property while Asset Management is done in-house. Using our proven platform, you can be sure that your investment is in good hands. TOPAZ is able to structure and customize the exchange to fit your specific investment objective and will be with you all the way to make sure that objective is accomplished.

TOPAZ TEN31 Structure

TOPAZ’s expertise in both debt and equity deals gives us the ability to properly identify the perfect property for your 1031 needs. Acting as the sponsor, TOPAZ will tie up the deal and work with our in−house lawyers to collect the information needed to prepare the exchange documents. Post−closing, TOPAZ will work with our regional property managers to manage the property while Asset Management is done in−house. Using our proven platform, you can be sure that your investment is in good hands. TOPAZ is able to structure and customize the exchange to fit your specific investment objective and will be with you all the way to make sure that objective is accomplished.

additional details

To align the interests of TOPAZ with investors, TOPAZ commonly co-invests through a TIC structure, contributing more sponsorship dollars than the industry average in acquisitions and developments. For 1031 investors with over $10M in their Exchange/Qualified Intermediary account, TOPAZ offers an exclusive 1031 structure focused on cash flow through an Asset Management agreement. This arrangement is designed for longer-term holdings and provides more favorable economics for the “1031 one-check investor”.

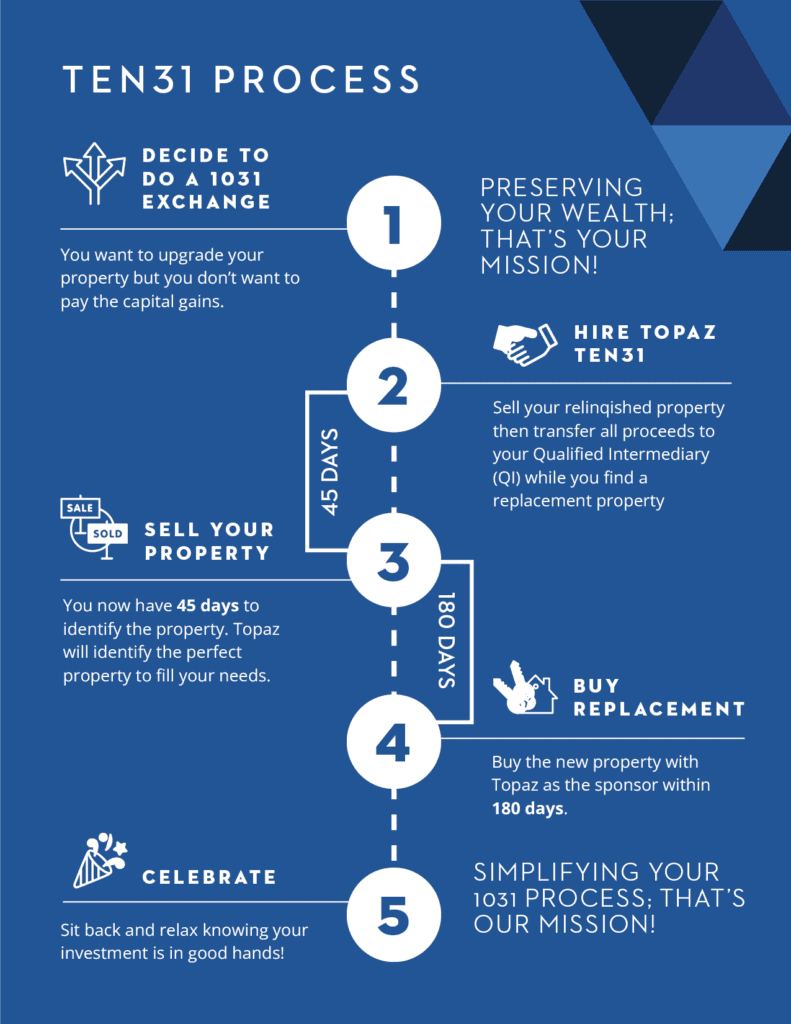

TEN31 Process

BENEFITS

- Defer capital gains taxes on the sale of your property.

- Invest in cash flowing multifamily properties that offers upside.

- Ensure certainty of execution and let Topaz manage the asset.

- Diversify your portfolio with valuable multifamily assets.

RISKS

- A 1031 Exchange is a complicated transaction. Investors should consult their tax professionals.

- The underlying investments in real estate are liquid investments.

- Investors who fail to complete their 1031 exhange in the allowable time (typically 180 days) lose their capital gain tax protection.

- Each investment has its own risks and the investor should review offering materials for a full review of those risks.

What is a 1031 Exchange? The most common type of 1031 Exchange is used for real estate, likely due to the broad definition of what is considered “like-kind” for Real Estate (or Real Property) Exchanges. In general, any type of U.S. real property held by the client for productive use in a trade or business, or for investment purposes can be exchanged for more real property as long as the properties are of “like-kind”, regardless of grade or quality. For most 1031 Real Estate Exchanges, the taxable gain is due to a combination of the appreciation in value and the amount of depreciation taken over the period of time that it was owned by the client. Many investors like to see what kind of tax savings they can benefit from when they sell their investment property.

*A 1031 exchange (which is listed under Section 1031 of the IRS code) is a like−kind exchange, according to the IRS. It is used by investors to buy and sell similar investments while postponing taxes on the profits generated along the way. According to the IRS, under the Tax Cuts and Jobs Act, Section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property.

TOPAZ TEN31 Xchange Deck

TOPAZ TEN31 Xchange was created solely for our clients as a one−stop shop offering multifamily−centric replacement properties, capital advisory, trusted tax and legal counsel, and creative multiple−owner structures we’ve created for 1031 exchange transactions nationwide!

Contact your Topaz TEN31 Representative at TEN31@TopazCG.com for more information.